Welcome to the special edition of the Blockchain Threat Intelligence newsletter where we will explore blockchain security incidents and events from the year 2020. In case you never heard of Blockchain Security, or just blocksec, it is a new security field with the mission of securing and defending the cryptocurrency ecosystem. It encompasses security of blockchain protocols, consensus mechanisms, smart contracts, key storage, exchange security practices, blockchain investigations, and other related topics.

The Good, the Bad and the Ugly

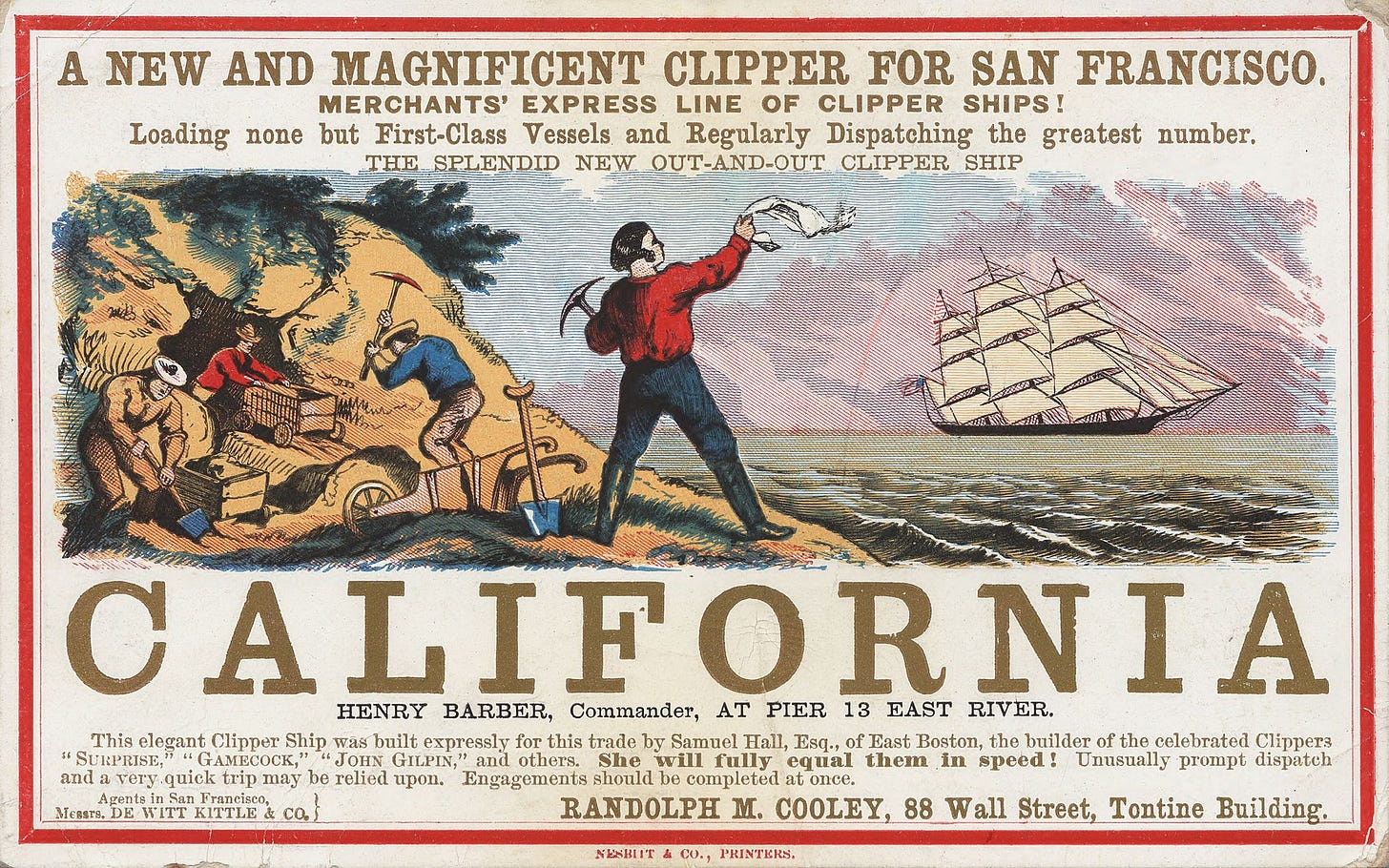

The current state of the blockchain industry resembles the California Gold Rush of the middle 19th century America. There is a similar rush of folks venturing into the unknown frontier of cryptocurrency trading and DeFi investing often leaving their livelihoods and previous jobs behind. My home town, San Francisco, has plenty of reminders of that era such as signs of abandoned and buried ships left by crews eager to try their luck at striking it rich with gold.

Unfortunately, that same spirit attracted not only the hard working folks, but also criminals, scammers, and other miscreants. But not all is bad in this new frontier. Just like in the old west, new blockchain security companies and whitehat hackers are joining the fight to bring law and order to the new and vulnerable industry.

In this edition of the newsletter, I will expose the bad, celebrate the good, and explore the evolving battlefield which is the Blockchain Security.

Keep reading with a 7-day free trial

Subscribe to Blockchain Threat Intelligence to keep reading this post and get 7 days of free access to the full post archives.